south dakota sales tax license

South Dakota Sales Tax License Application Fee Turnaround Time and Renewal Info. We have all the rules and requirements for obtaining this certificate down and are ready to help.

How To File And Pay Sales Tax In South Dakota Taxvalet

The Government of South Dakota implemented a policy from November 1st 2018 that mandated remote sellers with specific qualifications to have a mandatory South Dakota sales tax license and subsequently pay the necessary sales tax.

. The South Dakota Department of Revenue administers these taxes. If you are stuck or have questions you can either contact the state of South Dakota directly or reach out to us and we can register for a sales tax permit on your behalf. Please call the South Dakota Department of Revenue at 8008299188 or email them.

Get Your Sellers Permit for Only 6995. They may also impose a 1 municipal gross receipts tax MGRT that is in addition to the municipal sales tax. The municipal gross receipts tax can.

South Dakota Sales Tax License- Current Update Feb 2022. Get Your Sellers Permit for Only 6995. South Dakota Directors of Equalization knowledge base for property tax exemptions sales.

Obtaining your sales tax certificate allows you to do so. You will need this license to sell or lease tangible personal property admissions or services as a retailer or wholesaler. This process is handled through the State Department of Revenue located at 1520 Haines Ave Suite 3 Rapid City SD 57701.

Type of business entity. Municipalities may impose a general municipal sales tax rate of up to 2. Ad Simplify the sales tax registration process with help from Avalara.

South Dakota Directors of Equalization knowledge base for property tax exemptions sales ratio and growth definitions. A manufacturers license is required if your business fabricates or manufacturers items which are sold to other companies for resale and if your company has a manufacturing facility in South Dakota. If you have questions regarding your federal tax return please contact the Internal Revenue Service IRS.

Find information about the South Dakota Commission on Gaming laws regulations and the seven types of gaming licenses issued to the general public. How to contact the South Dakota Department of Revenue if you have questions. This license will furnish your business with a unique sales tax number SD Sales Tax ID Number.

Ad Apply For Your South Dakota Sales Tax License. A South Dakota sales tax. Please call the South Dakota Department of Revenue at 8008299188 or email them.

Register for a South Dakota Sales Tax License Online by filling out and submitting the State Sales Tax Registration form. Quickly Apply Online Now. Once you complete the online process you will receive a.

Complete in Just 3 Steps. Avalara can help you automate the business license application process. Sole Proprietorship Partnership Corporation Limited Liability Company LLC.

If the report is sent out of state South Dakota sales tax does not apply. Prior to beginning to tattoo or body pierce the artist must obtain a SOUTH DAKOTA SALES TAX LICENSE. Information needed to register includes.

Lottery for Individuals. Sales tax license ST. Find information about the South Dakota Commission on Gaming laws regulations and the seven types of gaming licenses issued to the general public.

Since then the law obligates any business. If the report is sent out of state but the property is located in state the client will owe use tax based on where the property is located. South Dakota Sales Tax License- Current Update Feb 2022.

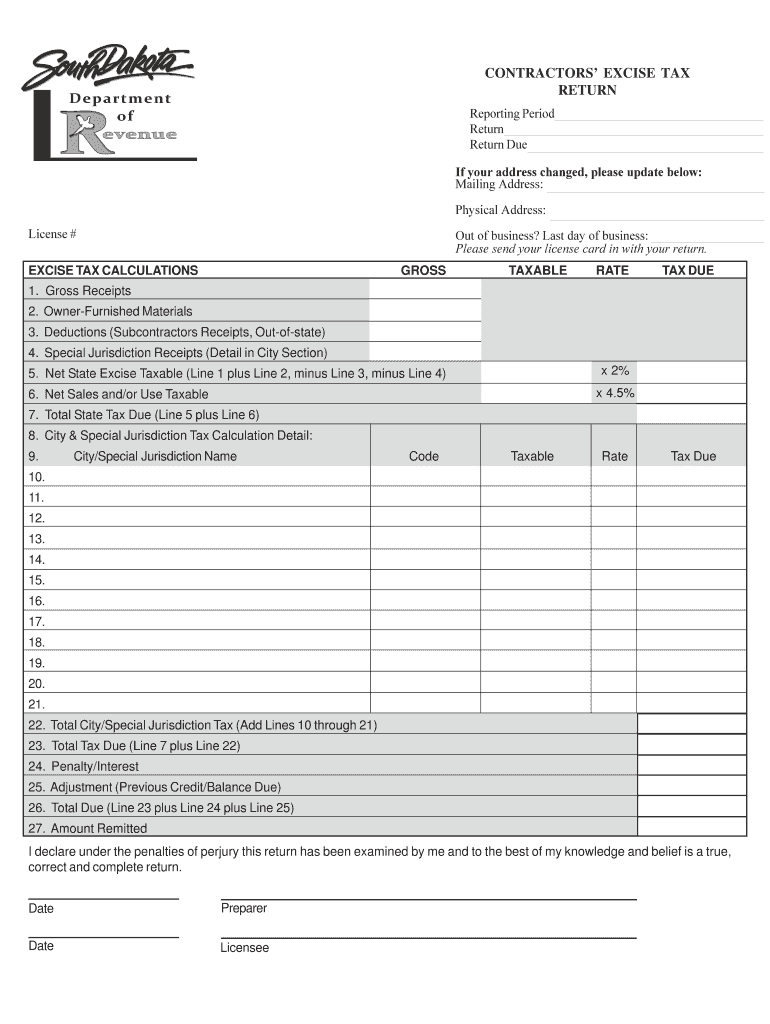

Types of Licenses in this Application Alcohol Contractors Excise Manufacturer Sales Use Wholesaler All Motor Fuel Tax Types Lottery Tobacco. Ad Apply For Your South Dakota Sales Tax License. South Dakota Department of Revenue 445 East Capitol Avenue Pierre SD 57501 Phone.

Quickly Apply Online Now. Ad 1 Fill out a simple application. If the report is sent out of state South Dakota sales tax does not apply.

Ad South Dakota Sales Tax License Same Day. In South Dakota the main license a business needs to obtain is the sales tax license or sellers permit. You will need to pay an application fee when you apply for a South Dakota Sales Tax License and you will receive your permit 1-5 days after filing your application.

License Requirements for Sales Use Contractors Excise Tax. 2 Get a resale certificate fast. South Dakota does not impose a corporate income tax.

Ad South Dakota Sales Tax License Same Day. South Dakota Department of Revenue 445 East Capitol Avenue Pierre SD 57501 Phone. If the report is sent out of state but the property is located in-state the client will owe use tax based on where the property is located.

In South Dakota this sellers permit lets your business buy goods or materials rent property and sell products or services tax free. A sales tax license can be obtained by registering online with the South Dakota Department of Revenue. Complete in Just 3 Steps.

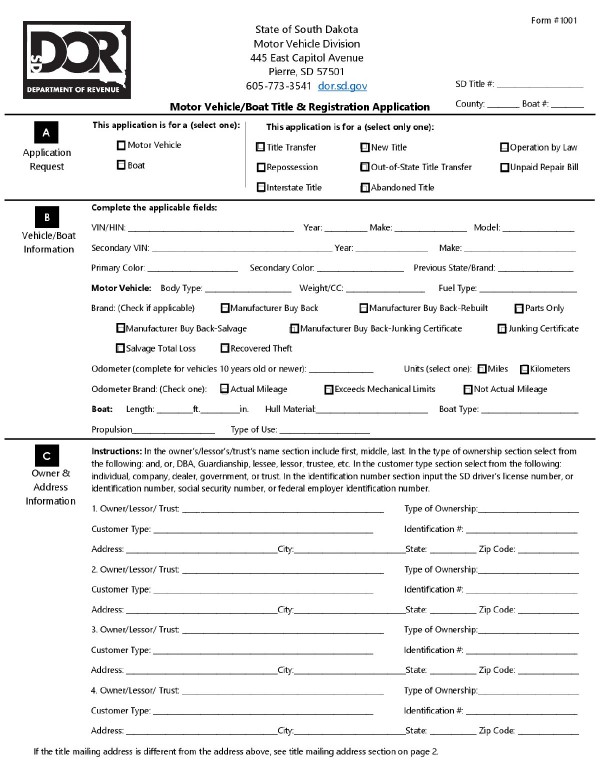

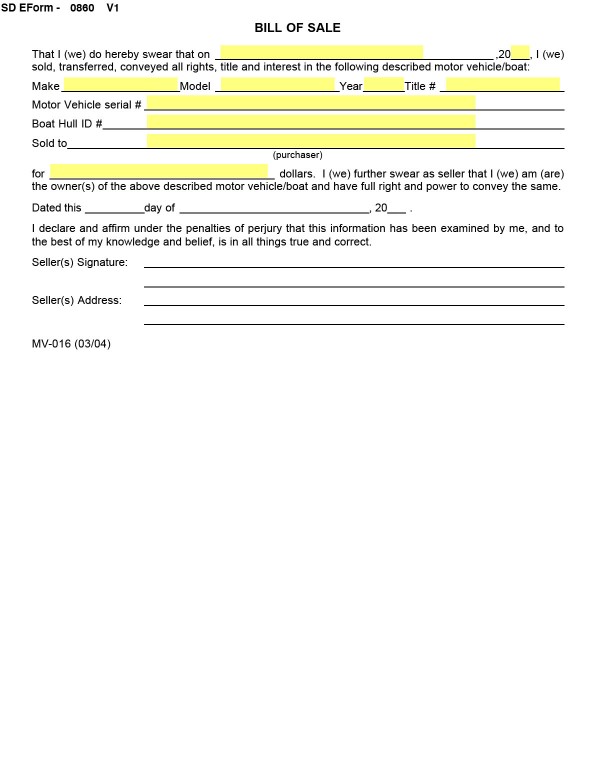

Bills Of Sale In South Dakota The Forms And Facts You Need

Last Day Of Business Fill Out Sign Online Dochub

South Dakota State Veteran Benefits Military Com

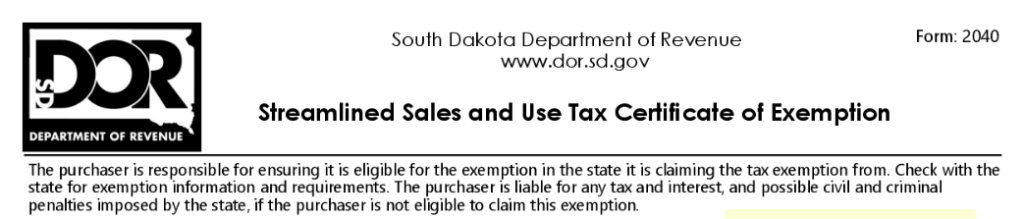

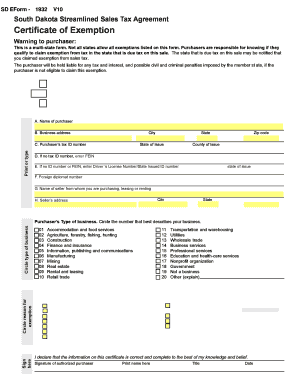

How To Get A Certificate Of Exemption In South Dakota Step By Step Business

How To File And Pay Sales Tax In South Dakota Taxvalet

Prime Contractors Exemption Certificate State Sd Us State Sd Fill Out Sign Online Dochub

Sd Eform 1932 V10 Fill Online Printable Fillable Blank Pdffiller

Bills Of Sale In South Dakota The Forms And Facts You Need

How To Register For A Sales Tax Permit In South Dakota Taxvalet

Form Mv 044 Fillable Application Forphysically Disabledparking Permit And License Plate

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

Form Mv010 Fillable Application For A Duplicate Certificate Of Title

How To Start A Business In South Dakota A How To Start An Llc Small Business Guide

How To File And Pay Sales Tax In South Dakota Taxvalet

Incorporate In South Dakota Starts At 49 Zenbusiness Inc

How To Use A South Dakota Resale Certificate Taxjar

Form Rv 140 Fillable Direct Payment Permit Application